The worst-hit victims are the poor and the ill-informed.

By Sajjad Bazaz

There are thousands of depositors who are struggling to get their money back after depositing it in unregistered schemes. Most of these depositors don’t report it to law enforcing agencies and fight at their own level. However, there are victims who file complaints against entities running such unregistered deposit schemes. The Reserve Bank of India (RBI) has received 1,540 complaints related to the non-repayment of deposits and money collected for various kinds of investment schemes (964 in 2020-21, and 576 in 2021-22).

Central Bureau of Investigation (CBI) has registered 100 cases relating to Ponzi schemes during the years 2019 to 2022, involving 132 entities. 21 persons have been arrested by CBI in this regard.

The Directorate of Enforcement (ED) has investigated 87 cases related to Ponzi schemes under the provisions of the Prevention of Money Laundering Act, 2002 (PMLA) over the last 3 years.

According to the Serious Fraud Investigation Office (SFIO), the Ministry of Corporate Affairs (MCA) has assigned them the job of investigation into the affairs of nine cases (five in 2019-20, one in 2020-21, and three in 2021-22) involving 85 companies during the last three years, which were allegedly engaged in fraudulent chit fund/ Multi-level Marketing (MLM)/Ponzi activities.

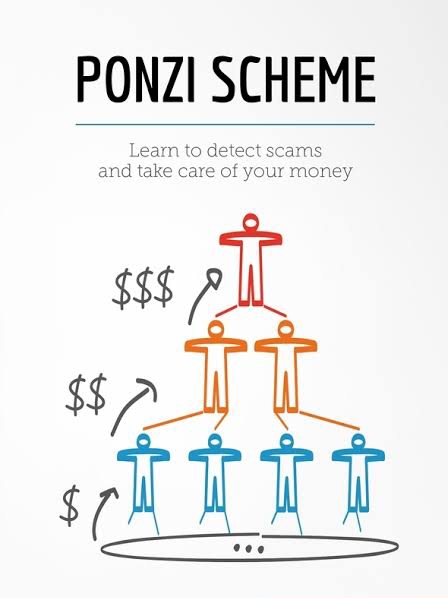

Ponzi schemes are actually fraudulent financial activities where gullible investors are promised high rates of return at little to no risk. A Ponzi scheme generates returns for early investors by acquiring new investors. These schemes usually collapse in on themselves when the chain of investors breaks and new investments stop.

Investors are paid from money collected from new investors instead of the scheme’s earnings. The scheme runs as long as new investors keep investing in the scheme. We can put it as a fraudulent investing scam promising high rates of return with little risk to investors. This scam actually yields the promised returns to earlier investors, as long as there are more new investors. Once the new investments stop, these schemes collapse.

With the advent of technology, the concept of Ponzi scheme, named after swindler Charles Ponzi who floated the first such scheme in 1919, also got transformed. The worst victims of these unregulated schemes have been the poor and the financially ill-informed populations.

During the Covid crisis, online Ponzi schemes surfaced. The fraudsters launched mobile apps luring users to invest money, with promised return on investment (ROI) at 1% a day. They even issued debenture certificates to people, assuring high returns and many investors have lost crores of rupees after being trapped in these certificates.

The ugly face of Ponzi schemes resurfaced in a big way in April when the Enforcement Directorate (ED) accused the Indian unit of the US-based company, Amway, of running a “multi-level marketing (MLM) scam” in the country and attached its assets worth Rs 757.77 crore. In other words, Amway India is accused of running a multi-level-marketing (MLM) scheme or pyramid scheme under the garb of direct selling, which “induces the common gullible public to join as members of the company and purchase products at exorbitant prices.” The ED probe has found the prices of most Amway products “exorbitant” as compared to the alternative popular products of reputed manufacturers available in the open market.

In order to curb the menace of pyramid and MLM schemes, which are in other words Ponzi schemes, the government in December 2021 notified the stringent Consumer Protection Rules, 2021. Under these rules, direct-selling companies are required to comply with them in 90 days. These rules prohibit companies from operating MLMs, or money-circulation schemes, in the garb of direct selling.

It’s envisaged that the sale of products cannot be linked to commission income earned by referring prospective customers. The direct-selling agents have to have a verified identity, physical address and a fair and equitable, documented agreement with the company. The direct-selling company would also have to take responsibility for redressing customer grievances against its agents.

These fresh regulations among other things make it illegal for direct sales firms to charge their agents registration fees or to charge them for the cost of demonstrating to potential buyers.

In short, financial frauds become the order of the day when there is a downturn in the economy as it puts pressure on people’s income. It’s here that the fraudsters leverage the depressing situation to their advantage and lure people through the so-called financial benefit schemes. In other words a Ponzi trap is laid to rob gullible people of their monies.

To understand the modus operandi of a Ponzi schemer, ask yourself a simple question: Is somebody promising you extraordinary returns on your investment in a scheme which is outside the formal financial system? If so, beware! It could be a Ponzi trap.

As far as saving yourself from Ponzi traps is concerned, the responsibility lies on your shoulders. We have seen most of the investors want their money to grow leaps and bounds in a short span of time. It’s this greed for easy money which makes people fall for it. Before investing in a pyramid or MLM scheme, investors should, at least, ask two questions to its promoters. How does the scheme plan to generate high returns? What’s the underlying business model?

It’s very important for you to understand the business model of the scheme. Fraudsters will usually describe their schemes in a most complicated way to confuse you. If you don’t understand the business model or the operational method of the scheme, avoid investing in it.

Remember, Ponzi schemes follow a multi-level marketing model. In this model, they may even offer commission to investors to get more investors on board, besides, promising high returns with low risk. The fund company running Ponzi schemes may also display company registration certificates and other documents to pitch as genuine. Registration certificates or any other government stamped paper may be genuine, but the most important part is to find out the relevance of the business model of the company. So don’t get lured by the government registration certificates or other such documents.

Lastly, unregulated Ponzi schemes continue to be the biggest money trap for gullible savers. There is a mushroom growth of these schemes which their promoters use to swindle gullible peoples’ money. Robert L Fitz Patrick, founder of the International Association to Expose, Study and Prevent Pyramid Schemes (pyramidschemealert.org) says the modus operandi of this menace stands extended to the cryptocurrency businesses as they have also adopted similar tactics and strategies which often include mind control and financial abuse.

There is a need to widen the crackdown on such entities (firms running pyramid, MLM and other Ponzi schemes) and save the innocent savers/investors from mind-blogging losses.

Sajjad Bazaz heads Internal Communication & Knowledge Management Department of Jammu & Kashmir Bank Ltd. The views expressed are his own and not of the institution he works for.