Credit score is a summary of a borrower’s past and current borrowing and repayment history.

Sajjad Bazaz

Some time back, a student, who had approached a bank for education loan, shared an interesting story with me. His application was rejected despite his parents having sufficient income on the ground that their credit score was bad.

The parents were surprised as they had no idea what ‘credit score’ meant.

While seeking the exact meaning of ‘credit score’ from the bank official who had done appraisal of the study loan application, they were astonished to learn that the bank knew about their poor repayment of earlier loans taken a few years back from some other bank.

It is now a practice with the banks to check the credit scores of parents whenever they receive a study loan request. The reason for taking credit scores of parents into account while processing an education loan application is that students will not have any such credit history and as such the parents for being co-borrowers (as per education loan scheme it’s mandatory for parents to be co-borrowers) of the loan are to be assessed under the credit score system.

In the post-Covid scenario, the financial system and the regulations governing it are undergoing never-seen-before changes, especially in the retail credit market. Consequently, banks are forced to respond to the changing scenario by redesigning their customer management frameworks. They are continuously realigning their loaning strategies in line with new set of COVID-induced risks. The banks are now exercising extraordinary caution while lending to different sectors of the economy, especially in the retail segment, where risk mitigation procedures will be stringent.

In fact, the loan appraisal procedures were already stringent. If we peep into the pre-COVID banking scenario, we find the banking industry was already crumbling under the burgeoning non-performing assets (NPAs) or what is commonly referred to as bad loans. Even as huge corporate loans are major contributors to this bad loan scenario which has already put survival of some big banks at stake, it is mainly the retail segment constituting of individual borrowers, which was also facing the brunt. The brunt was induced by the banks as they had done away with the liberal loaning policy. In other words, the loaning in pre-COVID crisis had already become more stringent as banks, while reviewing a loan application, were observing certain stringent risk-measuring tools to decide whether to extend the loan or decline the request.

Now in the post-Covid scenario, the banks have come under unprecedented pressure to keep their asset quality intact and avoid slippages. The loaning norms are more stringent and the prospective borrowers, those who look to banks for financial assistance through varied loan schemes, would be facing a tough time while complying loan eligibility norms.

Now, let’s have a look at the issue of credit scores in the context of the student loan which was denied to the parents for ‘bad credit score’. So, awareness about the subject makes sense. While talking in the context of J&K, the most interesting part is that most of the customers are unaware that their credit history is at the fingertips of any bank or financial institution. They are unaware that their behavior towards borrowing and repayment of loans earns them credit scores which are precisely defined as good or bad scores.

It’s the lack of financial awareness among people here which is a matter of concern. Otherwise, the primary responsibility rests with the financial institutions to make their customers aware about the nature and impact of financial transactions of whatever nature they conduct at their outlets. The awareness has not to be confined to the products and services they offer, but it has to be broad-based. They have to regularly update their customers about the changing landscape so that total financial discipline in line with the envisaged rules and regulations is observed by them. Nevertheless, a financially disciplined customer is an asset for banks/financial institutions.

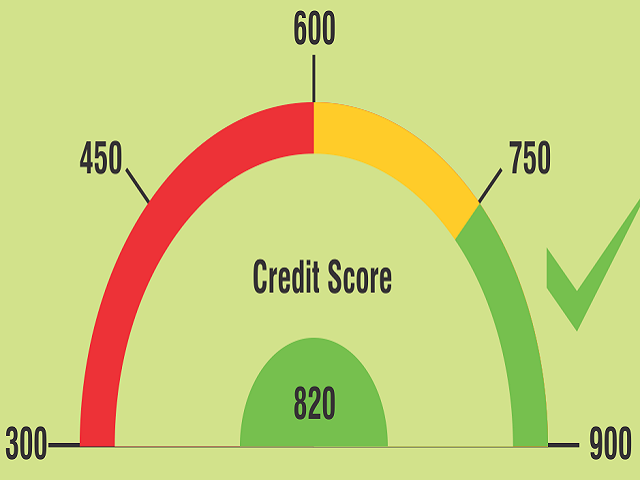

Credit score is a number summed up on the basis of a credit report – a summary of borrower’s past and current borrowing and his/her repayment history. This report is prepared by a credit bureau agency. If a borrower has been regular with his/her loan repayments, credit score is likely to be higher. It is the credit score that reveals a borrower’s repayment capacity and even helps banks and other financial institutions to assess the chances of a borrower defaulting on the loan.

Meanwhile, when we think of credit scores, mentioning the Credit Information Bureau (India) Limited (CIBIL) is inevitable. CIBIL, mostly referred to in credit scores, is an agency that provides the credit score and reports on an individual’s payments pertaining to loans and credit cards. It’s this CIBIL score which shows borrowers’ creditworthiness and indicates the probability of a default on the basis of their credit history.

Remarkably, there are other credit bureaus, namely, Equifax, Experian and CRIF High Mark. It is these credit information bureaus that generate credit reports.

In the given financial landscape and the stringent lending scenario, it’s inevitable for the borrowers to maintain a financial discipline of highest order to register themselves with high credit scores. They should utilize the loan limit efficiently without diverting funds from the core activity for which the loan has been sanctioned/disbursed. After availing the loan, they have to make sure that they pay their installments well on time. If they own a credit card, then let them pay the bills in full one time, rather than making a due payment every time. It’s equally important for them to be a guarantor for only those people whom they consider creditworthy. Never allow your cheques to bounce.

It’s in the fitness of things to exhibit a safe appetite for loans and display good financial discipline to earn a good credit score.

A credit report (also known as CIR i.e. Credit Information Report) is an individual’s credit payment history across loan types and credit institutions over a period of time. It does not contain details of your savings, investments or fixed deposits.

As all of us know, banks ask for a guarantor for certain loans as a means of security for the loan amount they provide. Let it be clear that a guarantor, for any type of loan, is equally responsible to ensure repayment. The guarantor provides a guarantee to the bank that he/she will honor the obligation in case the principal borrower is unable to do so. Any default on the payment of the loan by the principal borrower will affect the guarantor’s credit score as well.

A high credit score essentially means less probability of a default. A low CIBIL credit score reflects high probability of a default.

RBI has made it mandatory for the banks to comply with an individual’s desire to access his or her credit report. If a bank declines a credit card or loan application, you can ask for the control number of your credit report. You can then contact CIBIL at info@cibil.com and communicate details of errors in the report.

Sajjad Bazaz heads Internal Communication Department of Jammu & Kashmir Bank Ltd. The views expressed are his own and not of the institution he works for.