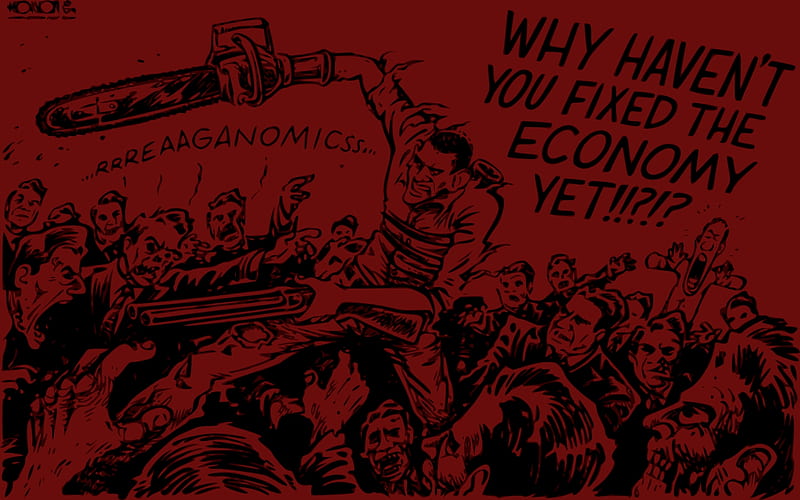

The economic data that is emerging from around the world is grim and points towards a dark future. The recession, it appears as of now, is imminent and it is going to impact all sectors of the society.

Take, for example, the situation in the United Kingdom where inflation surged to a new 40-year high in July on rising food prices, worsening the cost-of-living crisis. The Bank of England has warned that inflation will climb to just over 13 percent this year.

In the United States of America, the inflation jumped to 9.1 percent in June which is the fastest rise there since 1981.The cost of energy in the US has jumped 41.6 percent in the last year while groceries have gone costlier by 12.2 percent.

The current inflation in most countries, including India, is unsustainable and is going to worsen the cost of living.

In India, the wholesale inflation rate has been 15.18 percent in June and 13.93 percent in July. The wholesale inflation rate, which is the indicator of price rise in wholesale markets, has remained in double digits in India since April last year.

Shaktikanta Das, the Governor of Reserve Bank of India, this week stated that the retail inflation in India is “unacceptably and uncomfortably” high. This grim acknowledgment from the top man of India’s central bank should be a serious concern and an alarm to prepare for the imminent challenges.

Whatever happens beyond the boundaries of Jammu and Kashmir should be a concern for policymakers as well as for concerned citizens of this region as the economy remains strongly interlinked and interdependent.

In Jammu and Kashmir, the impact of global recession and high inflation within India will have a profound impact and badly dent the cost of living. There are several reasons why this will happen.

Within Jammu and Kashmir, Kashmir valley is landlocked with a narrow passageway of Jawahar Tunnel serving as its surface connection with the other economies. This passageway is prone to blockades during winter months as snow, mudslides and shooting stones frequently cut this connectivity.

The entire import and export structure, thus, depends on this passageway, making the regional economy turbulent and susceptible to sudden and sharp price rises.

The lack of train connectivity with the other regional economies and dependence on truck-based transfer of goods also adds more burden of hefty transportation charges. Also, Kashmir being a tail-end of India’s geographic structure has the burden of being a tail-end economy.

With such a difficult geographical reality, that overrides or undercuts in the profits’ game, Kashmir is a disaster in waiting, if immediate redressal measures aren’t put in place.

The impact of the rising inflation is already prevalent in Kashmir’s retail market. The cost of daily use commodities is already registering a remarkable jump, in many cases the prices have doubled. Take for example maize, which is widely used in the livestock market in Kashmir during winter months.

The maize in Kashmir is mainly imported from markets in Punjab, Haryana and Delhi – the three nearest wholesale bazaars which are at a distance of 500 – 800 kms. The retail cost of maize last year in Kashmir was in the range of Rs 1800-2000 per quintal; this year, the retail prices are upwards of Rs 3500 per quintal. Wheat prices jumped from Rs 2400 per quintal last year to Rs 3300 per quintal.

This phenomenal increase in the rate of grains will crumble an entire part of Kashmir’s rural economy as the livestock industry contributes 11 percent to the Gross Domestic Product.

The state of affairs vis-a-vis the once-booming construction business in Kashmir is also alarmingly grim and those associated with it suggest a fall in demand of nearly 80 percent owing to the unbearable rise in cost of material. The slowdown of the construction business is an unhealthy trend as it indicates an immobilisation of the flow of money.

The prices of groceries, cooking oil and daily household items are also registering a rise that is not at all sustainable, if the costs continue to rise at the current rate.

With inflation going almost out of control and the global economic situation appearing to be at war with itself, it is time for the administration to increasingly promote, aid and invest in the local market.

There is a large untapped potential in the rural economy that – if it is streamlined, guided and aided – can ease the pressure of rising inflation within Kashmir. The lack of processing units for agricultural and horticultural products, which could add important value addition to the raw product, is an urgent need of the hour.

The administration also needs to go beyond its call of duty and acknowledge the unfolding crisis. It has to liberally invest in the manufacturing industry, promote and aid the private players, and ease and aid the introduction process of new players, so the local raw produce can be utilized and processed into a ready for import end-product.

The PPP, or the Private-Public Partnership, can be an effective model to move forward in this direction. The bureaucratic sluggishness, which can slow this process towards self-reliance, will have to also transform itself.

The tailpiece: The economic crisis is real and Kashmir is unprepared to face it. The crisis will not slow its pace, so the need is to hasten the remedial measures. Much time is already lost.